According to section 45 of the Income Tax Act,1969 any profits or gains arising from the transfer of a capital asset effected in previous year will be chargeable to income-tax under the head ‘capital gain’.

Such capital gain will be deemed to be the income of the previous year in which the transfer took place.

What is Capital Asset?

According to section 2(14), a capital asset means property of any kind held by an assesses, whether or not connected with his business or profession

However, it does not include – Stock-in trade: Any stock-in-trade, other than securities, consumable stores or raw materials held for the purpose of the business or profession of the assessee and Personal effects, that is to say, movable property (including wearing apparel and furniture) held for personal use by the assessee or any member of his family dependent on him.

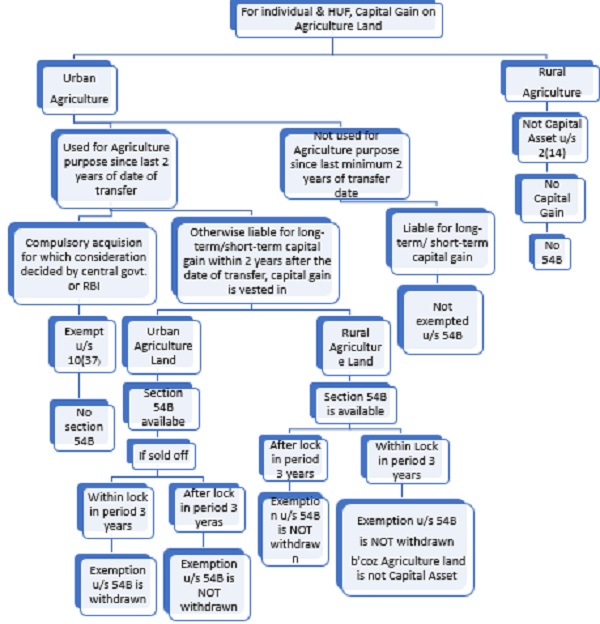

Treatment of capital gain tax on sale of Rural agricultural land in India i.e., agricultural land in India which is not situated in any specified area.

As per the definition, only rural agricultural lands in India are excluded from the purview of the term ‘capital asset’. Hence urban agricultural lands constitute capital assets. Accordingly, the agricultural land described in (a)and (b) below, being land situated within the specified urban limits, would fall within the definition of “capital asset”, and transfer of such land would attract capital gains tax –

(a) agricultural land situated in any area within the jurisdiction of a municipality or cantonment board having population of not less than ten thousand, or

(b) agriculture land situated in any area within such distance, measured aerially, in relation to the range of population as shown hereunder-

| Shortest aerial distance from the local limits of a municipality or cantonment board referred to in item (a) | Population according to the last preceding census of which the relevant figures have been published before the first day of previous year. | |

| 1. | >10000 | |

| 2. | >2kms but | >100000 |

| 3. | >1000000 |

Explanation regarding gains arising on the transfer of urban agricultural land – Explanation1 to section 2(1A) clarifies that capital gains arising from transfer of any agricultural land situated in any non-rural area (as explained above) will not constitute agricultural revenue within the meaning of section 2(1A).

In other words, the capital gains arising from the transfer of such urban agricultural lands would not be treated as agricultural income for the purpose of exemption under section 10(1). Hence, such gains would be eligible to tax under section 45.

(i) Specified Gold Bonds: 62% Gold Bonds, 1977, or 7% Gold Bonds, 1980, or National Defence Gold Bonds, 1980, issued by the Central Government;

(ii) Special Bearer Bonds, 1991 issued by the Central Government;

(iii) Gold Deposit Bonds issued under the Gold Deposit Scheme, 1999 or deposit certificates issued under the Gold Monetisation Scheme, 2015 and Gold Monetisation Scheme, 2018 notified by the Central Government.

Note – Property includes and shall be deemed to have always included any rights in or in relation to an Indian company, including rights of management or control or any other rights whatsoever.

Type of Capital Assets

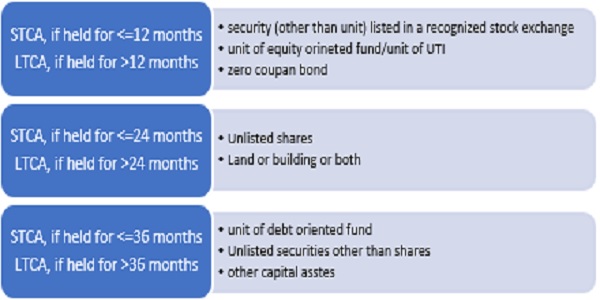

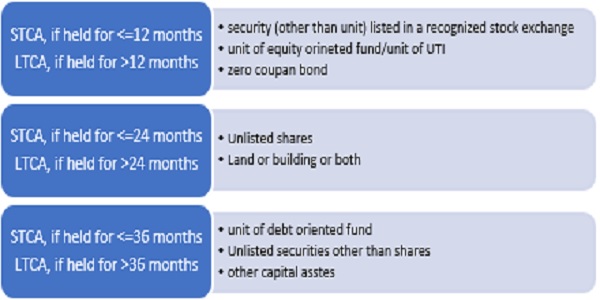

There are mainly two types of capital assets: Short term capital (STCA) & Long term capital asset (LTCA)

As per section 2(42A), short-term capital asset means a capital asset held by an assessee for not more than 36 months immediately preceding the date of its transfer.

As per section 2(29A), long-term capital asset means a capital asset which is not a short-term capital asset.

Thus, a capital asset held by an assessee for more than 36 months immediately preceding the date of its transfer is a long-term capital asset.

Exceptions:

A security (other than a unit) listed in a recognized stock exchange, or a unit of an equity-oriented fund or a unit of the Unit Trust of India or a Zero-Coupon Bond will, however, be considered as a long-term capital asset if the same is held for more than 12 months immediately preceding the date of its transfer.

Further, a share of a company (not being a share listed in a recognized stock exchange in India) or an immovable property, being land or building or both would be treated as a short-term capital asset if it was held by an assessee for not more than 24 months immediately preceding the date of its transfer.

Thus, the period of holding of unlisted shares or an immovable property, being land or building or both, for being treated as a long-term capital asset would be “more than 24 months” instead of “more than 36 months”

Summary of STCA <CA

MEANING OFTRANSFER

The provisions of section 2(47) of the Income Tax Act contains an inclusive definition of the term “transfer”. Accordingly, transfer in relation to a capital asset includes the following types of transactions-

(i) the sale, exchange or relinquishment of the asset; or

(ii) the extinguishment of any rights therein; or

(iii) the compulsory acquisition thereof under any law, or

(iv) the owner of a capital asset may convert the same into the stock-in-trade of a business carried on by him. Such conversion is treated as transfer, or

(v) the maturity or redemption of a zero-coupon bond; or

(vi) Part-performance of the contract: Sometimes, possession of an immovable property is given in consideration of part-performance of a contract.

(vii) Lastly, there are certain types of transactions which have the effect of transferring or enabling the enjoyment of an immovable property.

Computation of Capital gain

There is long term capital gain on long term capital asset &short-term capital gain on short term capital asset

In case of short-term capital asset:

| Particular | Amt. (₹) | Amt. (₹) |

| Full value of consideration receiving or accruing as a result of transfer | Xxx | |

| Less: Expenditure incurred wholly and exclusively in connection with such transfer (for e.g., brokerage on sale) | Xxx | |

| Net Sale Consideration | Xxx | |

| Less: Cost of acquisition (COA) | Xxx | |

| Cost of Improvement (COI) | Xxx | |

| Short-term capital gain (STCG) | Xxx | |

| Less: Exemption under section 54B/54D | Xxx | |

| Short-term capital gain chargeable to tax | Xxx |

In case of long-term capital asset:

Less: Indexed Cost of acquisition (ICOA)

Cost of Acquisition × CII for the year in which the asset is transferred ÷ CII for the year in which the asset was first held by the assessee or P.Y. 2001-02, whichever is later

Rate of tax on Short-term Capital Gains

Short-term capital gains arising on transfer of (Residential House Property) Short-Term Capital Assets would be chargeable at normal rates of tax.

Rate of tax on Long-term Capital Gains

Long-term capital gains arising on transfer of (Residential House Property) Long-Term Capital Assets would be chargeable at 20%.

on sale of House Property & Eligible Exemptions" width="600" height="300" />

on sale of House Property & Eligible Exemptions" width="600" height="300" />

YEAR OF CHARGEABILITY

Any profits or gains arising from the transfer of a capital asset effected in the previous year (other than exemptions covered here) shall be chargeable to Income-tax under this head in the previous year in which the transfer took place.

Computation of capital gains in the case of transfer of land and building [Sec. 50C)-

Section 50C is applicable if the following conditions are satisfied-

1. There is a transfer of land or building or both. The asset may be long-term capital asset or short-term capital asset. It may be depreciable or non-depreciable asset.

2. Stamp duty value adopted (or assessed or assessable) by the Stamp duty authority in respect of such transfer is more than 110 per cent of sale consideration.

It is quite possible that stamp duty on the date of agreement (fixing the value of consideration) is different from stamp duty on the date of registration. In such a case, the stamp duty on the date of agreement may be taken (and not as on the date of registration). However, this rule shall apply only in those cases where amount of consideration (or a part thereof) has been received by way of an account payee cheque/draft for by use of electronic clearing system through a bank account (or through prescribed electronic mode*)] before the date of the agreement.

*As per rule 6ABBA, prescribed modes of electronic payment are (a) credit card, (b) debit card, (c) net banking, (d) IMPS (immediate payment service), (e) UPI (Unified Payment Interface), (f) (RTGS) Real Time Gross Settlement) (g) NEFT (National Electronic Funds Transfer) and (h) BHIM (Bharat interface for money) Aadhaar Pay.

| Different situations | Stamp duty value |

| When assessee disputes value adopted by stamp duty authority | Value adopted by stamp duty authority |

| Where the assessee has disputed value adopted by stamp duty authority under the stamp act (i.e., stamp duty proceedings) | The stamp duty valuation as finally accepted for stamp duty purpose. |

| Where the assessee claims before income-tax authorities that value adopted by stamp duty authority is more than the fair market value (but he has not disputed such valuation in stamp duty proceedings) | The assessing officer will have to refer the matter to the valuation officer and the fair market value determined by him will be substituted for stamp duty value (if value so determined is more than original stamp duty value, the original stamp duty value will be taken). |

VALUATION OF CAPITAL ASSET – WHEN CAN BE REFERRED TO VALUATION OFFICER

With a view to ascertaining the fair market value of a capital asset, the concerned assessing officer may refer the valuation of the capital asset to the valuation officer appointed by the income-tax department in the following cases:

1. Where the value of the assets as claimed by the assessee is in accordance with the estimate made by a registered valuer (who works in a private capacity under a licence issued by the central board of direct taxes and his valuation is not binding on the income-tax department), but the assessing officer is of the opinion that the value so claimed is

A. Less than its fair market value, or

B. At variance with its fair market value [sec. 55a(a)];

2. Where the assessing officer is of the opinion that the fair market value of the asset exceeds the value of the asset by more than Rs. 25,000 or 15% of the value claimed by the assessee, whichever is less; or

3. Where the assessing officer is of the opinion that having regard to nature of an asset and relevant circumstances, it is necessary to do so.

> Section 54: Residential House

> Section 54EC: NHAI or REC Bonds

> Section 54B: Agriculture Land

> Section 54F: 1 st or 2 nd Residential House

Case studies

This appeal by the assessee filed under Section 260A of the Income Tax Act, 1961 for the assessment year 2013-14. When The taxpayer Ms. Moturi Lakshmi appealed the ITAT’s order to the Madras High Court, the Hon’able Madras High Court, on 17 th August 2020 issued its decision that where an investment is made in new residential property, prior to the sale of the original residential property, any gain on the sale of the original property is eligible for long-term capital gains (LTCG) tax exemption under section 54 of the Income-tax Act, 1961 (ITA).

Background and facts of the case

The taxpayer Ms. Moturi Lakshmi is an individual who claimed an exemption under section 54 of the ITA in her income tax return for the financial year 2012-13, corresponding to assessment year 2013-14. Section 54 provides an exemption from LTCG tax on the sale of a residential property by an Indian resident individual who:

(In certain cases an individual may purchase or construct two residential properties.)

In the current case, the taxpayer had paid an advance deposit for purchasing an apartment prior to the sale of her original apartment, against which she claimed an exemption under section 54. The Assessing Officer (AO) disallowed the exemption since the investment was made prior to the sale of the first apartment. Both the Commissioner of Income-tax Appeals and the Income-tax Appellate Tribunal (ITAT) dismissed the taxpayer’s subsequent appeals and upheld the AO’s order.

Decision of the High Court

The High Court noted that the following substantial question of law arose in the case under consideration, namely whether or not for the purposes of section 54, the advance payment made by the taxpayer for the purchase of the residential apartment constitutes part of the purchase price, where the advance payment is made to the seller of the apartment prior to the date of sale of the original capital asset?

The High Court noted that:

In view of the above, the High Court held that:

In view of the above, the High Court allowed the benefit under section 54 with respect to the advance payment made by the taxpayer for the purchase of a residential apartment prior to the date of sale of the original apartment.

Legal Conclusion under Rulings

These ruling reaffirm the following principles:

The logic of the Law is to give relief to the taxpayer for residential house and thereby “ease of living” life. No assesse can cross this logic without paying capital gain tax.

Acknowledgement:-

Income Tax Act, 1961 as amended from time to time

The author of this Article is Student of Institute of Chartered Accountant of India, pursuing CA. The Author can be reached at email id [email protected]

Disclaimer: The contents of this article are for information purposes only and do not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.